LPKF - Laser manufacturing solutions

✅✅✅✅✅

LPKF is a provider of laser based system which are essential in production of printed circuit boards, microchips, automotive parts, solar panels etc.

The 1 year chart looks like this

The 52-week high is €33.35 and the 52-week low is €15.28, so with friday's close date of €23.08, we are right in the middle.

The development in 1y, 3y, 5y and 10year are all well positive with respective 13%, 173%, 219%, 231%! ✅

This is the 10 year chart

This doesn't say much to me - only that there was a peak in 2014, than it went sideways for 3-4 years and since 2019 it is on a steep way up!✅The 1 year chart looks like this

There seems to be some kind of support and resistance level at €24, since Nov 20' upwards trends, which ended in Feb-Mar 21 and seems to downward trending since then!

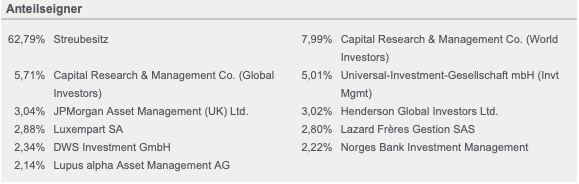

Stockholders view of LPKF:

Here we have some big star funds, e.g. Capital Group with over 13%! Surprisingly no Blackrock here! ✅The balance sheet asset side:

The assets have increase a little bit, but not that much, the biggest part is PPE (Property, Plant & Equipment) and a cash position of €20m! If you can keep the same asset size and increase your earnings, that would mean an efficiency increase of your assets!

The equity and liability side

Looks very healthy to me, the equity part has double the last 5 years, and the liabilities is almost down to 1/3! So of my top of my head, we have a D/E ratio of ~20%! They could easily pay of the long-term debt with their cash holding -> Strong balance sheet ✅On to the Income statement

We find a positive Net Income the last 3 years, decreased from 2019, crisis year of 2020, but that is ok for me!

We find a positive Net Income the last 3 years, decreased from 2019, crisis year of 2020, but that is ok for me!

Plus surprisingly they pay a small dividend of €.10cents per year the last 2 years, I would not have expected it here but it is a small surprise ✅

Other things I noticed looking through the site:

- Low ROE = 5.75% (This probably why they are paying out dividends instead of investing back into the company, as the return is probably lower than the Cost of Equity or very close to equilibrium)

- Low EBIT Margin = 7.43%

- Revenue growth the last 5 years, except 2020

- Market Cap = €565m

- Shares Outstanding = 24.5Mio

Comments

Post a Comment