The riskfree rate will be based, as the valuation is done in Euros, on the lowest default-free long term government bond in Euros - as of 20th Feb 2021 it is the German 10-year Long term Government bond with a yield of -0,35%.

(The riskfree rate is a view of the expected inflation in the Eurozone and the expected GDP Growth of the Eurozone!

Stepping ahead - Equity Risk Premium (ERP) - Section 4.5

I build my Risk Premium based on Revenues, due to the fact that the company is an IT company who develops and builds Test equipment and Hardware for integrated-Photonics applications, the main risk for an equity investor here comes from where the revenues are generated.

Below in the table you see the weighted average of ERP and in some countries as well including Country Risk Premium (CRP)!

| Region/Country | Revenues TTM | ERP | CRP | Revenue Weight |

| Americas | 203.9 | 4.72% | 0.00% | 31.06% |

| Asia/Pacific | 86.2 | 5.75% | 1.03% | 13.13% |

| Germany | 86.5 | 4.72% | 0.00% | 13.18% |

| Europe | 241.6 | 5.56% | 0.84% | 36.80% |

| Middle East/Africa | 38.3 | 7.40% | 2.45% | 5.83% |

| Group | 656.5 | 5.23% | <--------- | 100.00% |

As the main revenues for Jenoptik AG will continue to come from Americas and Germany, with a sligher increase in China, the Group's ERP will continue be around today's ERP!

Beta up my company - Section 5.5

Let's check up some Service Beta for Jenoptik:

Capital IQ: 1,82 (5Y); Yahoo Finance: 1,82 (5y Monthly); Morningstar: 1,45 (5-year); Onvista.de: 113 (DJ Stoxx 600) [ Correlation: 0,59 (DJ Stoxx 600)]; InfrontAnalytics: Lev beta 1,13 (3-year DAX30); finbox.com: 1,82 (5-year); avanza.se: 1,0185; FT.com: 1,5754; finanzen100.de: 1,00

Bottom-up BETA

To estimate the bottom-up beta for JenOptik, I check comparable firms in the same industry classification (source:

Damodaran Online)

| Industry | #Firms | Unlevered Beta |

| Electrical Equipment | 122 | 0.95 |

An alternative approach of measure risk, could be to look at the debt-to-equity ratio compared to the comparable firms.

The Debt-to-equity [book value] ratio for JenOptik is 58% (390m€/675m€) - which is higher as the comparable firms in the Electrical Equipment Industry Sector: 15,35%

Upward Step - Cost of debt and capital - Section 6.5

There is no bond or for that bond rating for JenOptik. Neither there is a current rating from Moodys on Jenoptik, in 2007 Moodys withdrew their rating! (link:

Moodys)!

To synthetic rating (based on Coverage ration) for Jenoptik is Ba1/BB+ -> Spread is 2,00%

(Interest Coverage ration= EBIT/Interest Expense = 32641/8156 = 4,00)

Pre-Tax cost of Debt = Risk-free rate + Default Spread for firm = -0,35% + 2,00% = 1,65%

(1,65% is the current cost to the firm of borrowing)

Using a marginal Tax Rate for Germany 2020 at 30%, we estimate the after-tax cost of debt to

Pre-Tax cost of debt * (1-t) = 1,65% *(0,70) = 1,155%

According to the Annual Report 2019, Jenoptik stated that, according to IFRS, the non-current financial debt includes lease liabilities of 72m€ (of total debt 123m€)! The latest Q3 report of Jenoptik showed an increase to 390m€ of total debt!!!

To calculate the Market Value of debt, I need first the average maturity 3,75 years based on the Annual Report 2019, the book value of debt is 390m€ (as shown before) and the interest payment of 8,156m€ at a pretax cost of debt of 1,65%

Estimated MV of Jenoptik debt = 396m€!

MV of equity = Market cap = 1598m€

| Jenoptik AG | Market Value | Book Value |

| Debt to equity | 24.80% | 57.78% |

| Debt/(Debt+Equity) | 19.87% | 36.62% | |

Cost of equity = Risk-free tare + β (ERP) = -0.35% + 1,11 * (5,23%) = 5,48%

{β-levered = β-unlevered [1+(1-t) (D/E)] = 0,95 * [1+(1-.3)(0,248)] = 1,11}

Cost of capital = Cost of equity (E/D+E) + Cost of debt (D/D+E) = 5.48%*(0,8013) + 1,155%*(0,1987) = 4,62%

Estimating Cash Flows

The EBIT or Operating Income for the TTM (as we only have the Q3 2020 report and not the full annual 2020 report) is 65,3m€

R&D is expensed as an Operating Expense, see above, and we need to capitalize it!

It has been very stable the last 5 years (between 40-45m€/year). Even though photonics are very specialized in research & developing I assume a 3-year R&D cycle, from R&D to product launch!

Year | R&D Expense (m€) | Unarmortized Portion | Amortization |

| (m€) | This Year |

| Current (2020 TTM) | 41.5 | 1 | 41.5 | 0 |

| -1 | 44.1 | 0.67 | 29.55 | 14.55 |

| -2 | 47.4 | 0.33 | 15.64 | 15.88 |

| -3 | 43.1 | 0 | 0 | 14.37 |

| Value of Research Asset | 86.69 |

|

| Amortization of research asset this year | 44.80 |

The adjusted EBIT = Operating Income + R&D Expenses - R&D Depreciation = 65,3 + 41.5 - 44.8 = 62m€

Effective Tax rate (from the last Q3 report) is: 17,5% (5,2m€/29,634m€) -> same as the stated in the Q3 2020 report!

Adjusted NetCapex:

| Items | (m€) |

| Capital Expenditures | 27.8 |

| - Depreciation | 34.8 |

| Net CapEx (Q3-2020 report) | -7.00 |

| + R&D expenditures | 41.5 |

| - Armortization of R&D | 44.8 |

| + Acquisitions | 220.4 |

| Adjusted NetCapEx | 210.10 |

Change in Working Capital

| (m€) |

|

|

|

| Working Capital | Q3 2020 | Q3 2019 | Change |

| Total Current Asset | 504 | 528 |

|

| Cash & Market Securities | 83 | 168.6 |

|

| Non-cash Current Assets | 421 | 359.4 | 61.6 |

| Total Current Liabilities | 239 | 251.9 |

|

| Non-debt Current Liabilities | 97 | 93.3 | 3.7 |

| Non-cash Working Capital | 324 | 266.1 | 57.9 |

Reinvestment rate = (Net CapEx + Change in noncash WC) / EBIT (1-t) = (210,10+57.9)/ 62 * 1-0.175) = 268/ 51,15 = 524%

Return on capital = EBIT (1-t) / (BV equity + BV Debt - Cash) = 51,15/ (675+305-82) = 5.7%

Tax benefits of R&D Expensing

Jenoptik did expenses their R&D and by that could achieve lowering taxes - now that we reversed and capitalised R&D, we have to adjust the operating earrings accordingly!

Additional tax benefit [Jenoptik R&D expensing] = (Current years R&D expense - Amortization of research asset) x Tax Rate = (41,5-44,8) x 17,5% = - 557,5k€

If we adjust the after-tax operating income to reflect the tax benefit, we end up in EBIT(1-t) + Tax benefit = 62m€ - 0,56m€ = 61,44m€- now this was not a big change since R&D expenses and amortisation was almost in the same ball park!

Estimating Growth

The arithmetic growth rate is higher than the geometric growth rate on all three averages, but the difference increase for EBIT averages as well as Net Income!

This is because the EBIT and Net Income differs more widely from year-to-year, e.g. standard deviation for net income is over 26%!

The geometric mean gives a much better understanding of the true growth, see at Net Income, who didn't grow at all from 2015 to 2020, it declined slightly (from 49,9m€ to 47,7m€) - even though the arithmetic average showed an increase of roughly 2%!

| Year | Revenues | Percent Change | | EBIT | Percent Change | | Net Income | Percent Change |

| 2015 | 668,6 | | | 59,4 | | | 49,6 | |

| 2016 | 684,8 | 2,42% | | 66,8 | 12,46% | | 57,4 | 15,73% |

| 2017 | 747,9 | 9,21% | | 82,3 | 23,20% | | 72,5 | 26,31% |

| 2018 | 834,6 | 11,59% | | 97,2 | 18,10% | | 87,6 | 20,83% |

| 2019 | 855,2 | 2,47% | | 92,4 | -4,94% | | 67,7 | -22,72% |

| 2020 | 764,5 | -10,61% | | 65,3 | -29,33% | | 47,7 | -29,54% |

| Arithmetic Average | 3,02% | Arithmetic Average | 3,90% | Arithmetic Average | 2,12% |

| Geometric Average | 2,72% | Geometric Average | 1,91% | Geometric Average | -0,78% |

| Standard Deviation | 8,63% | Standard Deviation | 21,39% | Standard Deviation | 26,17% |

Growth rates based on EPS regression came out as followed

| Year | Calendar Year | EPS | Percentage Change | ln(EPS) | |

| 1 | 2015 | 0,87 | | -0,1393 | |

| 2 | 2016 | 0,94 | 8,05% | -0,0619 | |

| 3 | 2017 | 1,27 | 35,11% | 0,2390 | |

| 4 | 2018 | 1,53 | 20,47% | 0,4253 | |

| 5 | 2019 | 1,18 | -22,88% | 0,1655 | |

| 6 | 2020 | 0,84 | -28,81% | -0,1744 | |

| Arithetic Average | 2,39% | | |

| Geometric Average | -0,70% | | |

| Standard Deviation | 27,57% | | |

| | Growth rate earnings per share with regression | 2,15% |

or Log-Linear based regression 1,98% - see graph below!

If we calculate the growth rate from ROE and the retention ratio, for Jenoptik we would get ROE = [67,6m€/597,3m€] = 11,32% and retention ratio of [retained earnings 2019: 44,6m€: Net Income 2019: 67,6m€] = 65,98% -> g = ROE * retention ratio = 7,47%!

If we look at the sector: Electric Equipment and its historical growth rate it was as followed:

- Net Income - Last 5 years - CAGR: 1,57%

- Net Income - Geo Avg - Jenoptik: -0,78%

- Net Income/EPS - Regression: 1,98%-2,15% (weighted average shares outstanding was the same during the last 5 years)

- Revenues - Last 5 years - CAGR: 4,21%

- Revenues - Geo Avg - Jenoptik: 2,72%

There are several analysts report out there, but unfortunately no one was accessible:

The

consensus view on Revenue and EBIT would give me one view of growth from analysts

"1 year[2020-2021]" Analysts Consensus growth rate Revenue:

15,16%"1 year[2020-2021]" Analysts Consensus growth rate EBIT: 44,09%

"1 year[2020-2021]" Analysts Consensus growth rate EPS: 35,63%

"2 year[2019-2021]" Analysts Consensus growth rate/CAGR Revenue:

14,68%"2 year[2019-2021]" Analysts Consensus growth rate/CAGR EBIT: 38,79,09%

"2 year[2019-2021]" Analysts Consensus growth rate/CAGR EPS: -0,4%

Break down of Return of Equity

ROE = ROC + D/E[ROC-i(1-t)]

| Return on Capital | Book D/E | Book Interest Rate | Tax rate | ROE |

| Jenoptik | 5,69% | 45,19% | 1,11% | 17,54% | 7,85% |

| Average and Marginal Returns |

| | | |

|

The return in equity is conventionally measured by dividing the net income in the most recent year by the book value of equity at the end of the previous year. That means that the return on equity measures the quality of both older projects that have been on the books for a longer time and new projects from more recent and earlier times. Since older investments represent a significant portion of the earnings, averaging returns may not shift the needle for larger firms when newer projects taken have worse return than older. That can cover up for bad returns on newer projects.

But, to measure theses returns, we compute a marginal return on equity!

Marginal ROE = "Change" in Net Income/ "Change" in BV of equity

For 2019, Jenoptik reported a Net Income of 67,6m€ on a book value of equity (2018) 597,3m€ which gives us a ROE of 11,32%

But the marginal return is as followed:

Change in Net Income 2018 to 2019 = 67,6m€ - 87,4m€ = - 19,8m€

Change in BV of equity 2017-2018 = 597,3m€ - 529,8m€ = 67,5m€

Marginal ROE = - 29,33% (downward momentum on Jenoptik 11,32% ROE above)

If we now, for example Jenoptik could improve the ROE from 11,32% to 13% (efficiency-generated growth) on existing and on new assets next year, everything else unchanged, the new growth rate would be g = 13%*65,98% + (0,13-0,1132)/0,1132 = 23,42%!

After that year, the growth will go back to 13%*65,98%= 8,58%

If the improvement would be only on existing assets and not on new, we would get

g = 11,32%*65,95% + (0,13-0,1132)/0,1132 = 22,31%!!

Reinvestment Rate

| | | | | | 2020 | Aggregate |

| EBIT | 59,4 | 66,8 | 82,3 | 97,2 | 92,4 | 65,3 | 463,4 |

| Eff Tax Rate | 13,09% | 11,64% | 9,24% | 4,38% | 20,66% | 18,15% | |

| EBIT (1-t) | 51,6 | 59,0 | 74,7 | 92,9 | 73,3 | 53,4 | 405,1 |

| CapEx | 17,7 | 25,7 | 30,3 | 36,6 | 33,5 | 27,8 | 171,6 |

| Depreciation | 27,6 | 27,2 | 28,2 | 30,4 | 43,7 | 45,4 | 202,5 |

| Change in WC | 5,6 | 5,7 | -7,8 | 12,5 | -2,7 | 9,6 | 22,9 |

| Reinvestment | -4,3 | 4,2 | -5,7 | 18,7 | -12,9 | -8 | -8 |

| Reinvestment rate | -8,33% | 7,12% | -7,63% | 20,12% | -17,60% | -14,97% | -21,29% |

Return on capital between 2015 - 2020

| | | | | | 2020 | Aggregate |

| EBIT | 59,4 | 66,8 | 82,3 | 97,2 | 92,4 | 65,3 | 463,4 |

| Eff Tax Rate | 13,09% | 11,64% | 9,24% | 4,38% | 20,66% | 18,15% | |

| EBIT (1-t) | 51,6 | 59,0 | 74,7 | 92,9 | 73,3 | 53,4 | 405,1 |

| BV of debt (start) | 162,4 | 128,8 | 124,5 | 128 | 121,5 | 159,6 | 824,8 |

| BV of equi (start) | 387,9 | 436,2 | 476,7 | 529,8 | 597,3 | 654,8 | 3082,7 |

| Cash Holdings | 69,8 | 84,3 | 142,5 | 197,1 | 151,9 | 169,9 | 815,5 |

| Invested Capital | 480,5 | 480,7 | 458,7 | 460,7 | 566,9 | 644,5 | 3092 |

| ROIC | 10,74% | 12,28% | 16,28% | 20,17% | 12,93% | 8,29% | 13,10% |

Value Enhancements

- Operating margin [8,54%] is lower than Industry Average [10,60%] (Capital IQ - 631 firms) and Damodaran online [12,82%] (122 firms)

- Effective Tax rate is 18,21% compared to the marginal tax rate of Germany 30%

- Net Capex/Sales is negative 2,31% versus 4,49% (Damodaran online)

| Jenoptik AG (XTRA:JEN) > Financials > Income Statement |

| | | | | |

| Income Statement | | | | | |

For the Fiscal Period Ending

| 12 months

Dec-31-2018 | 12 months

Dec-31-2019 | LTM

12 months

Sep-30-2020 | Industry Average | Damodaran Online |

| Currency | EUR | EUR | EUR | EUR | USD |

| | | | | | |

| Revenue | 834,6 | 855,2 | 764,5 | | |

| Total Revenue | 834,6 | 855,2 | 764,5 | | |

| Other Operating Exp., Total | 195,9 | 199,4 | 185,9 | | |

| Operating Margin | 11,65% | 10,81% | 8,54% | 10,60% | 12,82% |

| Operating Income | 97,2 | 92,4 | 65,3 | | |

| Interest Coverage Ratio | 24,30 | 19,67 | 8,70 | | |

| Interest Expense | (4,0) | (4,7) | (7,5) | | |

| Interest and Invest. Income | 0,5 | 0,4 | 1,8 | | |

| Net Interest Exp. | (3,5) | (4,3) | (5,7) | | |

| | | | | |

| Currency Exchange Gains (Loss) | 1,9 | (1,6) | (1,6) | | |

| Other Non-Operating Inc. (Exp.) | 0 | 0,0 | 0,0 | | |

| EBT Excl. Unusual Items | 95,6 | 86,6 | 58,0 | | |

| | | | | |

| Restructuring Charges | - | - | - | | |

| Merger & Related Restruct. Charges | (1,9) | (2,1) | (2,1) | | |

| Impairment of Goodwill | - | - | - | | |

| Gain (Loss) On Sale Of Invest. | (0,4) | 0,6 | 0,6 | | |

| Gain (Loss) On Sale Of Assets | (0,3) | 0 | 1,4 | | |

| Asset Writedown | (2,1) | (1,2) | (1,0) | | |

| Insurance Settlements | 0,6 | 0,5 | 0,5 | | |

| Other Unusual Items | - | 0,8 | 0,8 | | |

| EBT Incl. Unusual Items | 91,4 | 85,2 | 58,4 | | |

| Effective Tax Rate | 4,38% | 20,61% | 18,21% | 30% | ---------------> |

| Income Tax Expense | 4,0 | 17,6 | 10,6 | | |

| Earnings from Cont. Ops. | 87,4 | 67,6 | 47,7 | | |

| | | | | |

| EBIT (1-t) | 92,9 | 73,4 | 53,4 | | |

| + Depreciation | 30,4 | 43,7 | 45,4 | | |

| - CapEx | 36,6 | 33,5 | 27,8 | | |

| Net CapEx/Sales | 0,74% | -1,19% | -2,31% | | 4,49% |

| - Chg in WC | 22,2 | (10,6) | 16,5 | | |

| = FCFF | 64,6 | 94,2 | 54,5 | | |

| FCFF as percentage of revenues | 7,74% | 11,01% | 7,13% | | |

Loose Ends Part 1 - Cross Holdings

On the latest annual report 2019, under the Equity part, the were non-controlling interests of a value of €657k

Which you find as well into the Consolidated Income Statement after the Earnings after tax with a negative amount of €11k! So we make an assumption that this is a Minority "Active" Holding! In the report it is as well stated, that non-controlling interest are valued according to their proportion of the identifiable net assets. And the statement of Equity shows an acquisitions of non-controlling interest of €660k during 2019!

Pricing - relative valuations baby steps

The P/E ratio (P/LTM EPS - Price /Last Twelve Month Earning Per Shares) is 33,36x (35,3x for industry)

The P/BV ratio (Price/Book Value of Equity of Common Shares) is 2,46x (3,7x for industry)

Why is the P/E and P/BV for Jenoptik

The TEV/LTM EBIT (Total Enterprise Value/Last Twelve Month Earnings Before Interest and Taxes) is 28,54x (21,8x for industry)

The TEV//LTM EBITDA (Total Enterprise Value/Last Twelve Month Earnings Before Interest and Taxes plus Depreciation & Amortisation) is 16.84x (17,3x for industry)

On equity comparison, Jenoptik is "cheaper" than the sector and on firm comparison, Jenoptik is slightly more "expensive".

P/E ratio [current] : Market Cap/Fiscal Y-2019 NI = 1.567m€/67,7m€ = 23,14 (vs Industry 51,61)

P/E ratio [trailing] : Market Cap/LTM Net Income = 1.567m€/47,7m€ = 32,85 (vs Industry 106,2)

P/E ratio [forward] : Price per share/EPS 2020e = 27,38€/0,87€ = 31,47 (vs Industry 37,00)

P/E ratio [forward] : Price per share/EPS 2021e = 27,38€/1,18€ = 23,20

Expected PE based on following Europe Market regression

Expected PE = PE = 11.67 + 76.10 gEPS + 13.95 Payout - 1.47 Beta [R squared 24,9] =

[Payout ratio = 15,6% ; gEPS Analysts Median 3-5years = 5,71% ; Beta = 1,11]

= 11,67 + 76.10 (5,71%) + 13,95 (15,6%) - 1,47 (1,11) = 16,56 (by this the Jenoptik forward PE is overvalued by 23,20 compared to the market!)

PEG Ratio

From the comparable firms, my company has the highest PEG ratio of 3,39! Based on the market assumptions, that companies with PEG < are cheap, 2 companies are "cheap"

- II-VI Inc. and Meggitt PLC

Clearly we see that the comparable low growth rate is "hurting" Jenoptik

The forward PE for the 122 firms in the sector is 37, with an average low growth rate of 1,85% which would give us a comparable high PEG ratio of 15,93!

Other Ratios

In the sector, the comparable EV/EBITDA is 20,58 (122 firms) - compared to our company's 11,03!

If we compare our firm towards the sector average on following determining EV/EBITDA factors:

- Tax Rate: Jenoptik Eff. Tax Rate 13,91% vs 21,65% (Sector aggregated Tax rate) - higher Tax Rate lower EV/EBITDA - we have lower tax rate so this should drive a higher ratio

- Cost of Capital: Jenoptik WACC 4,62% vs 5,43% (for sector) - higher CoC should generate lower EV/EBITDA - again this is not matching up here either

- Reinvestment rate: Jenoptik > 500% vs 43,07% for sector -> higher Reinvestment rate should result in lower EV/EBITDA multiple.....here is the first match!

- Expected Growth rate: Jenoptik 5,71% vs 8,08% for sector -> higher growth should give us higher EV/EBITDA - so here is the second match!

Book Value Multiples

Equity version = PBV = Market Cap/BV Equity => 1469,9/597,951 = 2,46

[ROE= 11,32% ; CoE= 5,48%; Payout Ratio = 20,2%]

Enterprise Multiple = EV/IC = (1469,9+387,96-148,731)/(597,951+387,96-148,731) = 2,0

[ROC = 8,29% ; CoC = 4,62% (almost double as in the multiple a factor of 2)]

Revenue Multiples

As part of our revenue multiple pricing, compared to the comaprable firms in the sector is at or around the median, both for EBIT % Margin and EV/Sales

The correlation between the EBIT Margin and EV/Sales is 0,92 - which is very high!

The basic regression, EV/Sales to EBIT Margin gives us following formula: EV/Sales = 1,28+ 14,3x(EBIT % Margin).

If we use the regression to predict EV/Sales and to find over/undervalued compared to the actual trading price!

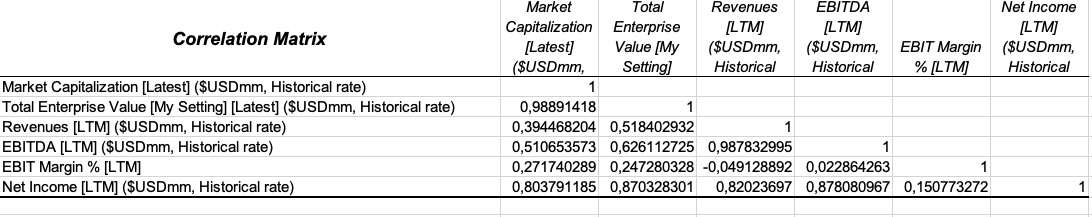

When I used a larger sample size of 81 companies within the Industry, I ran a correlation of Market Cap against some basic Income measures and got following correlation matrix

When I used the same sample to generate some other calculations on the mean, median and 25th & 75th percentile for PE, EV/Sales and EV/EBITDA

If we look at the PE, Jenoptik is prices slightly lower than the Median PE of 38,28 - but compared to the EV/Sales and EV/EBITDA, Jenoptik is in the lower 25th percentile

Comments

Post a Comment